Filed late

Their last pro was too busy.

No handoffs. No guesswork. Just one trusted partner for your books, payroll, and taxes — with answers, not auto-replies.

⭐ Trusted by business owners across industries — 5-star rated on Upwork

Their last pro was too busy.

Issues lingered for years.

Waiting days for answers.

Returns filed without book checks.

Every return, every time.

Email & text for quick questions.

Proactive updates you can trust.

Understand what’s happening & why.

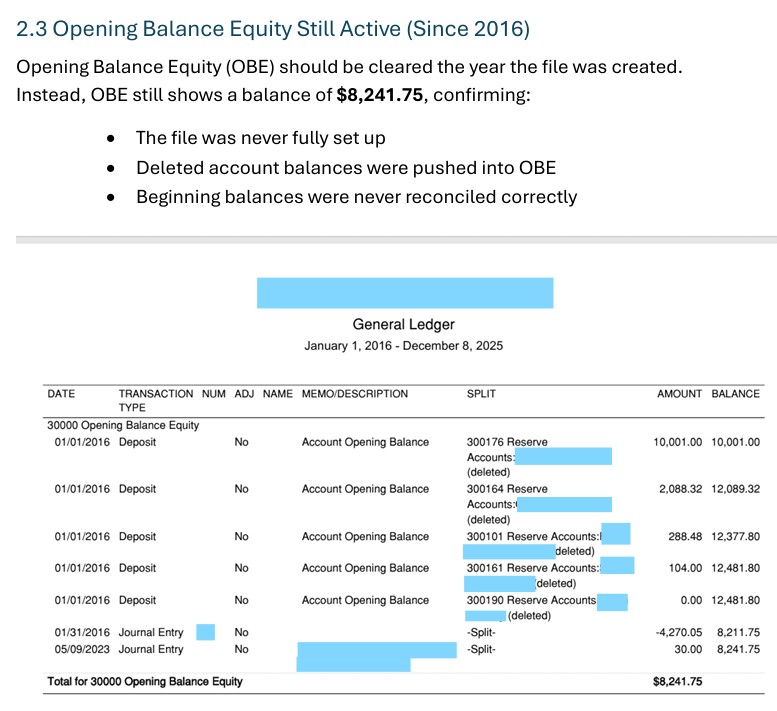

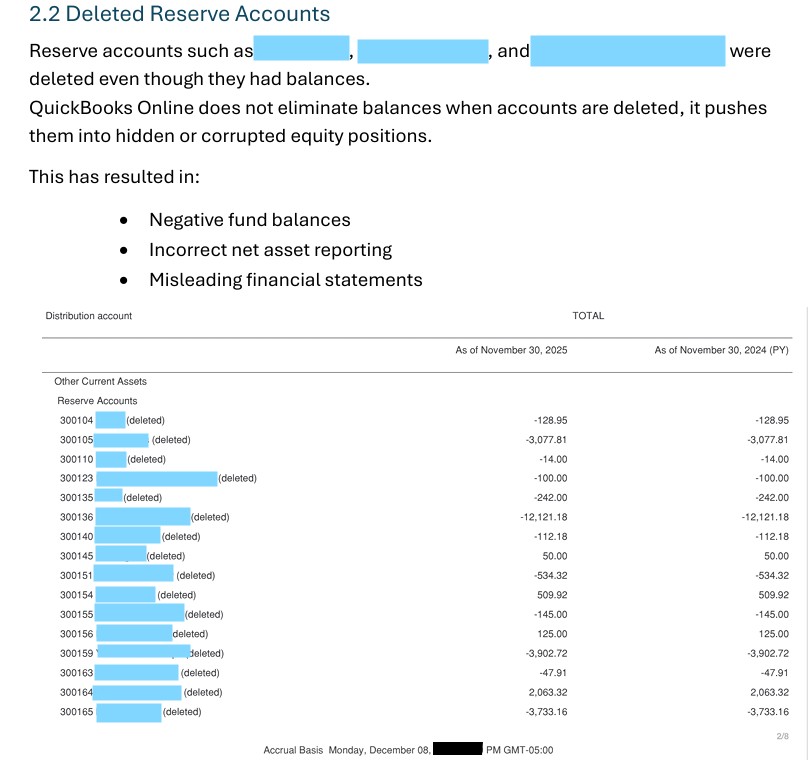

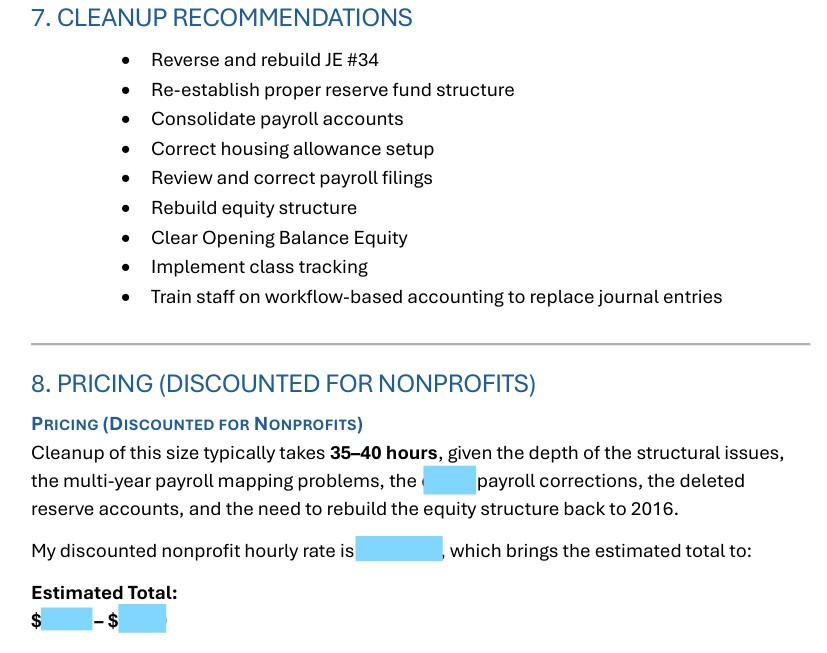

Finding issues that others miss — and showing you what they are and how to fix them.

Delivered within 48–72 hours after access is granted.

Certified in the tools your business already uses.

Short, verified quotes from clients and references.

CPA thank-you letter · State tax return

Kelly located a carry forward credit that the PA Department of Revenue had lost and continued to follow up until it was applied to my client's return quickly and accurately.

Consistent attention to detail and timely communication kept AR/AP flowing smoothly. Highly recommend.

Construction & investment · View image

Knowledgeable, ethical, communicative, and trustworthy. Strongly recommend.

Construction · View image

Thanks for sticking with this long client onboarding process.

Real estate investment · Sage 50 year-end + migration to QBO

Hi Kelly! You are a rockstar.

Community wellness clinic · QBO cleanup for 2023

New roofing company: initial QuickBooks Online setup and ongoing hourly accounting support.

Roofing / construction

Kelly has been doing my individual taxes for the last few years. I had no idea my summer landscaping work was technically a business. She proved how much it would save me at tax time having a small business with full time W-2 work. I have been saving receipts ever since.

Landscaping · Individual → business tax & bookkeeping

Customizable year-end package for any revenue size.

A complete year-end solution designed to close the year correctly, understand what the numbers actually mean, and file with confidence.

This package is fully customizable based on the condition and complexity of your books.

The base package covers the essential work required for an accurate, defensible, and compliant year‑end.

Year‑End Cleanup & Close

This phase ensures the books are accurate and complete before analysis or tax filing begins.

INCLUDED

This is due‑diligence level cleanup appropriate for year‑end close. It does not include forensic reconstruction.

Outcome: Books that are clean, accurate, and ready for review.

Year in Review

Once the books are clean, the focus shifts from fixing to understanding.

INCLUDED

This answers the question: What actually happened this year, and why?

Outcome: Clear financial insight you can understand and use.

Tax filing is the final step and is completed using books that have already been reviewed and validated.

INCLUDED

Outcome: Returns filed correctly the first time, with fewer questions and delays.

Add‑ons for unique complexity. Added only if needed.

More than 4 bank/credit accounts.

Year‑end forms & submissions.

Prepare and file extra tax years.

Deep dive to fix complex issues.

Cleanup prior‑year books; historical corrections & tie‑outs.

Review, reconciliation, and filing support.

Add‑ons are scoped based on actual complexity, not assumptions.

Not sure what applies? If you’re unsure whether your books require only standard year‑end cleanup or additional forensic work, I’ll review the file and explain what’s required before any work begins.

Refer a client and you both save on service.

Book a free diagnostic or schedule your year‑end package today.

This is end‑to‑end financial support for business owners who want their accounting handled correctly, consistently, and in context.

It’s everything an accounting department would do in house — and more — fully customized to your needs.

This reflects steady‑state accounting, not backlog correction.

This is operational accounting infrastructure, not cleanup.

Payroll is managed as a controlled process, not a reactive fix.

Tax work is integrated into the accounting cycle.

Advisory is part of the role, not an add‑on.

Reporting supports decisions, not just compliance.

It’s a full‑service, in‑house accountant function that handles everything — and it scales as your business scales. Your scope is fully customizable based on volume, complexity, and how hands‑on you need support to be.

The packages below show a typical range for full service. If you need more or less, your package adjusts accordingly.

Example ranges for full service. Final scope is based on your actual books.

These businesses are typically owner operated with limited overhead, manageable transaction volume, and straightforward reporting needs. Operations are often lean, with the owner directly involved in all financial decisions.

Examples:

These businesses show consistent activity and typically operate full time. They may have limited contractor support or part time staff. Transaction volume increases, and reporting begins to matter more strategically.

Examples:

At this level, businesses often have structured payroll, multiple vendors, and clearer operational systems. Owners are managing teams and beginning to rely on stronger financial oversight.

Examples:

These businesses are managing payroll complexity, vendor volume, inventory or job costing, and more detailed reporting. Financial visibility becomes critical to protect margins.

Examples:

Companies in this range operate with significant transaction volume, layered staffing, and operational oversight needs. Internal controls, structured reporting, and margin monitoring become essential.

Examples:

These organizations typically operate across multiple entities, departments, or states. Financial reporting supports executive level decisions, long term growth strategy, and operational efficiency.

Examples:

Cleanup is not a side offering. It is one of my core specialties.

Cleanup and catch‑up is where I specialize. I spot inconsistencies, patterns that don’t reconcile, and errors that quietly compound over time. What feels invisible or overwhelming becomes visible once the file is reviewed — and then it becomes fixable.

For books that are behind but structurally sound

INCLUDES

Outcome: Clean, current books you can rely on for day‑to‑day decisions.

For books with compounding errors or unresolved prior‑year problems

INCLUDES

Outcome: Defensible financials that can be explained, supported, and trusted.

For a clean, confident handoff into tax filing or external review

INCLUDES

Outcome: Tax‑ready books that reduce questions, delays, and surprises.

Book a free diagnostic and I’ll tell you what’s required before any work begins.

Helpful tools, updates, and plain‑English guidance.

For guides, checklists, and helpful walkthrough videos including:

Tax articles, guidance, and walkthroughs — posted regularly.

If the feed doesn’t load, open the page here.

Use this official IRS tool to check W‑4 withholding and avoid surprises at tax time.

If your situation is complicated (multiple jobs, self‑employment, dependents, credits), I can help you set withholding and estimated payments correctly.

Book a free diagnostic and I’ll point you to the right next step.

Direct proof of real work — anonymized examples.

13‑month cleanup; deep dive corrections and tie‑outs.

Built financials from receipts/statements; depreciation + accountable plan; filed two years.

Breakeven, budgeting, forecasting, margin & labor tracking.

Job costing plus AR/AP workflows and dashboards.

Switch software while preserving historical records.

Raw material + WIP valuations and margin analysis.

A one‑person virtual accounting firm built for business owners who want clarity, structure, and clean books they can trust.

If you’ve ever had the pleasure of having a dachshund, you know exactly what I mean when I say they put 100% of themselves into everything they do.

That’s a value I strive for — along with other qualities that are unmistakable in the breed. A business that handles sensitive financial information should operate with the same traits you see in dachshunds every day:

The logo is also a tribute to Twix — my first dachshund, a chocolate dapple who was fiercely “dachshund” in every way.

Custom solutions for businesses of all sizes — built like an accounting department, without hiring one.

Bloss Financial Services is a one‑person virtual accounting firm serving businesses across the country. I bring custom solutions to businesses of all sizes because every owner deserves insight and reliable numbers to make decisions.

I have a passion for seeing small businesses grow and survive — watching people build the business of their dreams. That is exactly what I plan to do with my own business.

Someday, I want a local location in Erie, PA to serve local businesses face‑to‑face, while continuing to support clients remotely nationwide — bringing the values I believe should define financial services, which I display proudly through the dachshund logo and the way I work.

A one‑person firm — you work directly with me.

I was born in Misawa, Japan on a military base and grew up in Greene County, Pennsylvania. After high school, I moved to Erie, PA, where my family briefly lived after my father retired from the military and where our extended family is rooted.

I earned a Bachelor of Science in Accounting & Business Administration and a Bachelor of Arts in Communications from Edinboro University. I prepared taxes for individuals and small businesses directly after finishing college.

I then worked at Fiberglass Services Inc. (a water slide repair company), which allowed me to travel all over the country from 2012 until 2021 when the owner died and the business closed.

When I moved to Erie, I took a temporary role with the PA Department of Revenue in BETA (Bureau of Enforcement and Tax Assistance). After the season, I took a role with Performance Castings LLC, a small local metal foundry.

While pursuing these roles, I also took freelance work on the side — remotely — for small businesses in several industries doing cleanup work and ongoing monthly in‑house accountant services.

In June 2024 I started at Wm. T. Spaeder, a large mechanical contractor in Erie, PA, and have been there ever since working as a union payroll specialist while building my business into my dream: one day having a local location and serving Erie businesses as well as those I can work with remotely.

Side projects have included a bridal retail and e‑commerce store with a foreign manufacturing entity producing an in‑house brand, a book publisher, several construction companies (including roofing and excavation), and the Baltimore Outpatient Mental Health Center which needed a major cleanup.

I’m naturally inclined to find errors and I love helping businesses understand their financials, remove confusion, and use numbers to make better decisions.

Start with a free diagnostic. You’ll get screenshots and a plain‑English write‑up so you know exactly what’s going on and what it will take to fix it.

Click a question to expand.

I work best with business owners who value accurate financials, direct access to their accountant, and proactive oversight.

If you want your books correct, payroll reconciled, taxes filed properly, and reporting you can rely on, we will work well together.

If you are looking for the lowest possible price with minimal structure or oversight, I may not be the right fit.

No.

I provide full bookkeeping, payroll oversight and corrections, and tax preparation services. Most clients do not need to coordinate multiple vendors or manage handoffs between providers.

If CPA sign-off is required for a specific filing or engagement, I coordinate that directly.

This structure is designed to function as your accounting department, built around you.

Yes.

I oversee payroll accuracy, reconciliations, reporting, and correction of prior errors. This includes multi-state payroll when applicable.

If payroll filings or setups were mishandled previously, I review the situation, identify discrepancies, and guide corrective action.

You do not need to untangle payroll issues alone.

Yes.

I prepare and file business and individual returns where appropriate. Financials are reviewed for accuracy before filing.

When structural opportunities exist, such as reimbursement strategies or entity considerations, I evaluate those as part of the process.

I am actively pursuing CPA licensure during 2026. If formal CPA sign-off is required for a specific engagement, I coordinate that directly.

No. I operate as a single-person firm by design.

When you work with me, you work directly with me and my 15 years of hands-on accounting experience. You are not handed off to junior staff or routed through departments.

My experience was built through increasingly complex W2 roles in construction, manufacturing, payroll, and financial management, while simultaneously performing freelance and contract accounting work.

That combination created exposure across far more real-world situations than a single career track alone.

It depends on your structure.

Some monthly clients create a dedicated company email address such as accounting@yourcompany.com. This allows me to fully manage accounting department communication, vendor coordination, and payroll correspondence under your company domain.

Other clients prefer I use my business email. In those cases, I clearly identify the role I am operating under in each email.

Example:

Kelly Bloss

Tax Compliance and Admin

Big League Shirts

Bloss Financial Services

Accountant / Owner

The goal is to build the right structure for your company, whether that means embedding directly into your communication flow or operating externally.

I regularly support:

If your business produces revenue and requires structured books, I can review it.

I have worked with almost every major accounting and payroll platform in use today.

Accounting platforms include:

Payroll platforms include:

I have been recognized for my ability to quickly become a functional expert in new software environments. Adapting to unfamiliar systems has been a consistent part of my career.

I am currently certified in: QuickBooks, Xero, Sage. I also hold Advanced ProAdvisor status with QuickBooks.

If your system is not listed, ask. I can assess and adapt.

If you find me through Upwork, work follows the Upwork proposal and contract structure, either hourly or fixed price.

If you contact me directly through my website or referral, every engagement begins with a diagnostic review and written proposal.

This applies to ongoing monthly accounting, payroll support, tax work, and cleanup projects.

I review your starting point, document what is happening, identify issues, and define scope before quoting pricing.

Pricing without reviewing your books is guesswork.

The diagnostic allows me to:

From there, I provide a clear proposal with either fixed project pricing or a defined monthly cost.

That is common.

You will receive:

No judgment. Just structure.

Project-based engagements require a deposit before work begins.

Tax returns are not filed until the associated project balance is paid in full.

For larger cleanup or correction projects, clients commit to completing the defined scope once contracted.

This ensures clarity and protects both parties.

Ongoing accounting services operate on a month-to-month basis.

A 30-day written notice is required to cancel services.

This provides continuity and prevents disruption to financial reporting or payroll oversight.

For direct clients, I accept:

Payment terms are defined in the proposal before work begins.

If additional issues are discovered beyond the agreed scope, they are documented and quoted before proceeding.

There are no surprise invoices.

Monthly clients receive structured reporting and regular communication.

Project clients receive milestone updates.

You will know what is being done and when it is complete.

Access is limited to necessary systems. Secure accounting platforms and encrypted tools are used. Sensitive information is not requested through unsecured channels.

If it is accounting related, reach out. If I am not the right fit, I will tell you quickly.

Reach out and I’ll tell you quickly if I’m the right fit.

Prefer to reach out directly instead of using our Tally form? Send an email or call Kelly at kelly@bloss-financial-services.com • 814‑218‑3040.

Find out more about using my services by reaching out through my secure onboarding/contact form.